The benefits of a cross-ledger repo solution: or what JPMorgan, HQLAᵡ, and Ownera are trying to do

The repo market is often described as the beating heart of modern finance, a vast, intricate network that keeps liquidity circulating through the arteries of the global financial system. Every day, trillions of dollars of securities are exchanged for cash, with agreements to reverse the transaction at a later date. These repurchase agreements, or “repos”, underpin money market stability, central bank policy transmission, the functioning of credit markets, basically everything. But until recently, their operational mechanics have been burdened by settlement delays, collateral frictions, and fragmented infrastructure. Which sounds strange, given how important these markets are.

But this is about to change. In early August 2025, JP Morgan, HQLAᵡ, and Ownera quietly launched what could prove to be one of the most significant upgrades to repo market infrastructure in decades (yes, decades!). The announcement received only modest attention outside specialist circles, but its long-term implications are profound. By enabling intraday, cross-ledger settlement of repo transactions, the three institutions have addressed one of the market’s most persistent bottlenecks: the slow, costly, and operationally complex movement of cash and collateral across disparate systems.

At its core, the new solution allows repo traders to exchange cash held in JP Morgan’s blockchain-based deposit accounts with collateral registered on the HQLAᵡ platform, settling in real time and with maturity times set to the exact minute. What’s more, this is not a pilot or a controlled test environment, these are live, production-level trades between real market participants.

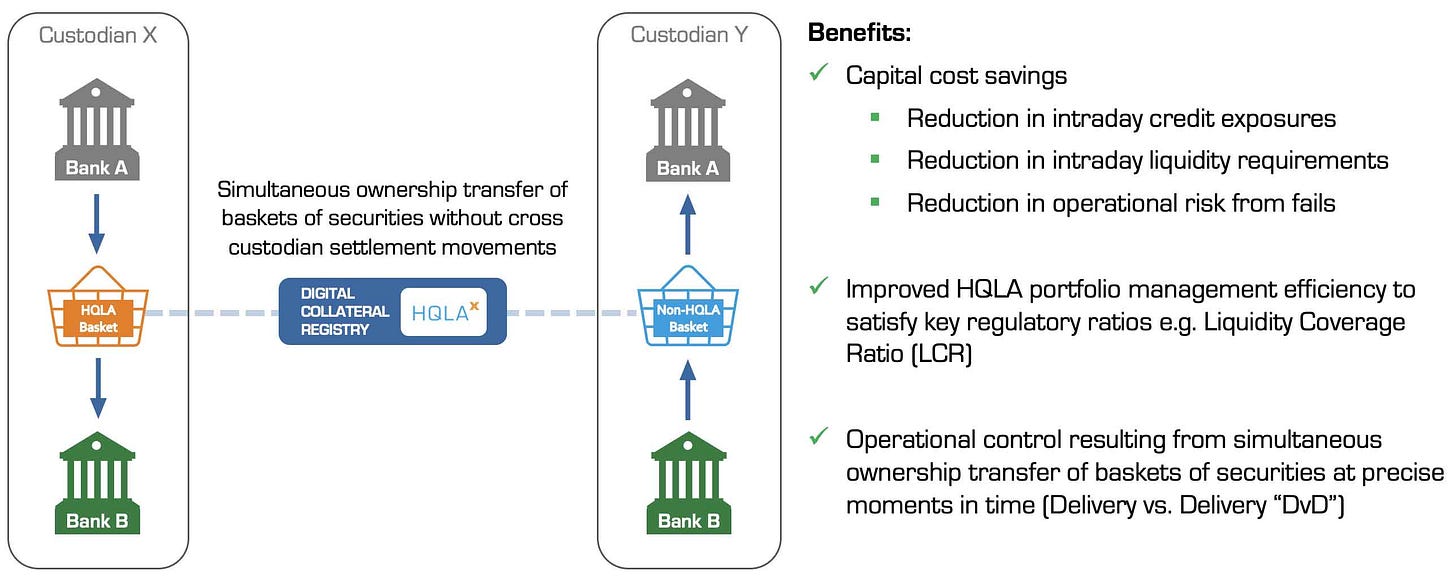

HQLAᵡ, established as a platform for collateral mobility, has for years focused on making high-quality securities (often held at custodians) available for rapid transfer between counterparties. The model revolves around creating a digital collateral receipt when a security is “locked” at a custodian. This receipt, which is not a blockchain token stricto sensu, can be transferred almost instantly between parties without moving the underlying asset itself. For collateral swaps, this was already a meaningful efficiency gain. But the platform lacked one key ingredient: a real-time cash leg.

Source: Securities Finance Times

That is where JP Morgan entered the picture. Through its Kinexys Digital Financing application, the bank has been offering blockchain-based deposit accounts capable of settling cash transactions instantly within its network. Marrying these accounts with HQLAᵡ’s digital collateral mobility opened the door to a fully integrated delivery-versus-payment (DvP) mechanism that could work intraday, not just overnight. For more clarity, DvP means that the transfer of the security (the "delivery") and the transfer of cash (the "payment") happen simultaneously and conditionally on each other, so one side only completes if the other does too. For example, in traditional repo or securities settlement, DvP eliminates the risk that one party delivers the asset but never receives the payment (or vice versa).

The final piece of the puzzle came from Ownera, a firm that does not operate its own blockchain but rather acts as a connective layer between multiple distributed ledger technology (DLT) systems. Using its FinP2P protocol, Ownera has created a routing layer capable of orchestrating transactions across different platforms, ensuring that the cash side on JP Morgan’s system and the collateral side on HQLAᵡ’s platform remain perfectly synchronized. This solves a long-standing challenge for DLT adoption in capital markets: interoperability (I will come back to this concept in a minute).

Ok, it sounds interesting. But the real question is: why does this matter? Well, the key reason is that the current repo settlement framework suffers from a number of structural inefficiencies (as I briefly mentioned earlier). Traditional settlement cycles, often on a T+1 or T+2 basis, mean that collateral is tied up and unavailable for reuse until the transaction is finalized. Cross-border repos are even more cumbersome, involving multiple custodians, market infrastructures, and operational checkpoints. This limits the ability of dealers to dynamically optimize their balance sheets and respond to intraday liquidity needs.

But that’s not all. More specifically, the legacy infrastructure behind many repo transactions still relies on outdated systems and manual reconciliation, which leads to settlement fails, processing delays, and higher operational risk. Moreover, collateral optimization remains a challenge, as most platforms lack real-time, cross-asset liquidity management, resulting in inefficient capital deployment. And in the case of repo markets, particularly in the United States, though not exclusively, there’s the problem of systemic concentration and infrastructure bottlenecks: the repo ecosystem depends heavily on a small number of large dealers and clearing banks, which amplifies vulnerabilities in times of stress and undermines (or could undermine) market resilience.

By digitizing both sides of the repo (cash side via JP Morgan’s Kinexys accounts and collateral side via HQLAx’s digital receipts) and enabling real-time DvP settlement across separate ledgers, this integration addresses several pain points at once: The most important one is the intraday liquidity optimization, meaning dealers can now borrow or lend cash for precise time windows, unlocking collateral for other purposes within the same day. Moreover, this partnership boosted collateral mobility and capital efficiency: Collateral can now be transferred across counterparties almost instantly without custodian movement, unlocking trapped assets and enabling real-time reuse (basically, reducing operational fatigue and eliminating days-long settlement cycles). On top of all this, another factor is decentralized access with scalability. What does that mean? Well, by connecting across ledgers and removing reliance on centralized rails, the solution opens direct market access for a wider range of participants and lays the groundwork for interoperability with future instruments like CBDCs and tokenized assets.

And here I should emphasize more this concept of interoperability. A critical enabler here is Ownera’s FinP2P protocol. One of the paradoxes of DLT adoption in capital markets is that while individual platforms have matured, they often operate in isolation. JP Morgan’s blockchain deposit accounts and HQLAx’s collateral receipts each have established user bases, but without an interoperability layer, their utility is limited to their own ecosystems. FinP2P functions as a routing utility, connecting participants peer-to-peer across different ledgers, and orchestrating transactions at the application layer.

This kind of interoperability it is a precondition for scaling institutional DLT solutions. Without it, the market risks replacing today’s fragmented infrastructure with tomorrow’s fragmented blockchains (I know it sounds paradoxical but this is a legit risk). The JP Morgan–HQLAx–Ownera collaboration demonstrates that cross-ledger solutions can operate in live production at scale.

As such, one of the most important aspects of the JP Morgan–HQLAᵡ–Ownera initiative is that it has been designed with scalability in mind. The architecture is not tied to a single bank, collateral source, or cash instrument. In principle, the same framework could be extended to multiple trading venues, additional collateral types, and a variety of digital cash solutions, including deposit tokens, regulated stablecoins, and central bank digital currencies (CBDCs).

Such an expansion would represent a significant step toward a more unified global repo market, reducing fragmentation and enabling broader participation. The potential to integrate with CBDC systems is particularly noteworthy, as it aligns with the long-term vision of a fully digital, programmable financial market infrastructure.

But of course there are challenges ahead. While the technological proof of concept is now a live reality, widespread adoption will depend on several factors. Regulatory acceptance is crucial, as cross-ledger settlement mechanisms will need to fit within existing legal frameworks governing securities ownership, transfer, and settlement finality. Market participants will also need to adapt operational processes to take full advantage of intraday settlement capabilities.

Moreover, the success of such systems depends on network effects. The more counterparties that connect, the more valuable the platform becomes. Building that critical mass will require not only technological interoperability but also trust between institutions, standardization of transaction protocols, and alignment on legal interpretations across jurisdictions. Of course, it matters greatly that JPMorgan, a (or the) leading global bank, is behind this process, and that’s exactly what gives me confidence today that this partnership can truly be scaled.

As a synthesis, by enabling near-instant settlement across platforms, the JP Morgan–HQLAᵡ–Ownera model tackles these frictions head-on. Collateral no longer needs to be physically moved between custodians; cash can be delivered in real time; and settlement can be timed to the precise needs of counterparties, whether for a few hours or the entire trading day. In operational terms, this means repo transactions can be executed, settled, and unwound with a degree of precision that was previously unthinkable. It also significantly reduces the counterparty risk that builds up when trades take days to settle, a risk that regulators and market participants alike have been eager to minimize since the 2008 financial crisis.

This flexibility could prove particularly valuable during periods of market volatility, when demand for safe collateral spikes and the speed of settlement becomes a decisive factor in maintaining market stability.

The bottom line is that for decades, the repo market has operated on infrastructure designed for an earlier era, where settlement delays were an accepted cost of doing business. JP Morgan, HQLAᵡ, and Ownera have now shown that those delays are not a necessity. By integrating real-time digital cash settlement with instantaneous collateral mobility across platforms, they have set a new benchmark for what is possible. If this model gains traction beyond its initial participants, it could reshape the way liquidity moves through the global financial system, making it faster, more flexible, and more resilient. I’m genuinely excited, not gonna lie!

Alexandru Stefan Goghie is a PhD candidate in the Department of Political and Social Sciences at Freie Universität Berlin, PhD researcher at JFKI’s Graduate School of North American Studies and PhD researcher at Global Climate Forum. His research focuses on geopolitics, the global financial system, monetary policy, and the geopolitics of finance”. You can follow him on his Substack https://goghieas.substack.com/