Collateral + Blockchain = Stability

In the previous article "Can new Settlement Structure save our financial system?" we explored the systemic frictions in the settlement layer of the repo market and how these can be addressed through integration of blockchain and tokenization solutions. In this article I will touch on another critical weak point of the repo market - Rehypothecation.

Opacity in collateral reuse—rehypothecation—is not merely a technical flaw in repo operations; it is a structural vulnerability embedded within the global dollar system’s architecture. Rehypothecation is what gives the Eurodollar system its elasticity, enabling credit to expand far beyond the nominal base of pristine collateral. But the same mechanism also conceals the recursive fragility of this credit system. The opacity isn’t accidental; it is foundational.

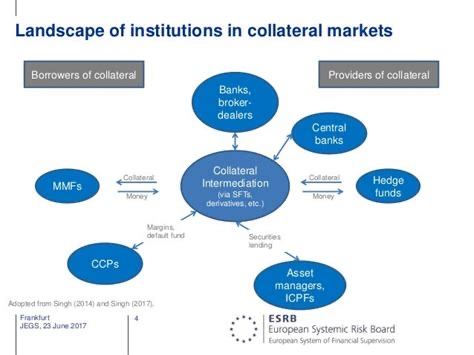

In a typical chain, a primary dealer enters into a repo agreement, posting a U.S. Treasury as collateral to a money market fund (MMF). Simultaneously, that dealer might have obtained the same Treasury via a reverse repo with a hedge fund or other client, or even through an internal securities lending agreement (s. illustration below). This same piece of collateral might change hands five or six times in a single day, crossing multiple balance sheets. Each time, it serves as the backstop for a short-term funding transaction. In theory, each link in the chain performs risk assessments and imposes haircuts. In practice, these assessments are opaque, uncoordinated, and based on incomplete information.

Critically, no institution—no regulator, no market participant—has a full map of collateral usage in real time. There is no central ledger of ownership claims, nor any reliable mechanism to prevent the same security from being pledged simultaneously in multiple overlapping transactions. What appears on a balance sheet as an “available” asset may in fact be encumbered downstream, creating hidden leverage and feedback loops that materialize only under stress.

The failures of Bear Stearns and Lehman Brothers were both accelerants of and symptoms of this mechanism. Both firms relied heavily on short-term repo funding, pledging collateral that was increasingly re-used and layered across complex derivative and funding arrangements. As confidence declined, repo counterparties demanded margin or refused to roll funding. Because the reuse of collateral was obscured, liquidity dried up faster than anyone had modeled, and institutions found themselves insolvent not due to asset quality per se, but due to the freezing of collateral channels.

This opacity is intrinsic to the Eurodollar system’s lack of centralized clearing. The entire offshore dollar system is governed by bilateral contracts, bespoke terms, and decentralized enforcement. The system functions only so long as all participants implicitly trust one another’s risk assessments and internal controls—a fragile foundation, particularly in periods of volatility.

Blockchain offers a categorical inversion of this architecture. In a properly constructed blockchain-based repo system, every transaction is recorded on a shared, permissioned ledger. The moment a U.S. Treasury is posted as collateral, a unique digital token representing the claim on that security is locked and cannot be simultaneously pledged elsewhere. Smart contracts govern this lockup, ensuring that only one transaction can encumber a given asset at any time. This solves the double-pledge problem at its root.

Consider a real-world implementation. A hedge fund pledges a Treasury token to a dealer in exchange for cash. The smart contract enforces a lock on the token. If the dealer wants to use that Treasury for a downstream repo with a custodian bank, it must first “release” the token by repaying the hedge fund or acquiring a rehypothecation right that is itself tokenized and traceable. The blockchain records the entire sequence, from original pledge to subsequent reuse, with timestamped, immutable logs.

At each node, the current encumbrance status is visible. Risk management systems at MMFs, central clearing counterparties (CCPs), or regulators can verify the collateral’s status before accepting it. If collateral has been pledged downstream or exceeds allowed reuse limits, the smart contract rejects the transaction.

This does not eliminate rehypothecation—it makes it observable. And observability fundamentally changes behavior. Institutions price liquidity more accurately. Haircuts reflect actual systemic exposure. Funding strains become visible before they metastasize. Supervisory stress testing gains granularity. Most importantly, market participants are forced to manage liquidity on real collateral availability, not on modeled assumptions.

Implementation of such a system is nontrivial. Legacy systems—internal ledgers, risk engines, and booking systems—must integrate with blockchain nodes. Custodians and CCPs must become infrastructure providers, operating validator nodes that authenticate and secure the transaction chain. Regulators must shift from ex-post surveillance to real-time oversight, embedding supervisory logic into the same smart contracts that govern collateral movement.

Critically, blockchain must be embedded within a tightly scoped permissioned network—not an open, anonymous chain. Access to transaction data must be tiered: counterparties can see their exposures, regulators can see full-chain usage, and system nodes enforce privacy-preserving auditability. Institutions like the DTCC and BNY Mellon are already piloting such models, but they remain parallel to core market infrastructure. To be effective, this architecture must replace—not merely augment—the legacy.

The Eurodollar system is already a distributed ledger system in spirit, just not in implementation. Every bank in the network maintains its own record of who owes what, who holds what. But these ledgers don’t reconcile in real time. Blockchain fixes that by introducing a common substrate where credit creation and collateral encumbrance are synchronized and visible.

Opacity in collateral reuse is not an operational oversight—it is the systemic blind spot of the global monetary system. Only by replacing bilateral trust with cryptographic validation and shared data integrity can that blind spot be eliminated. Blockchain doesn’t merely digitize repo—it renders the entire liquidity pyramid legible. And once legible, it can finally be governed in a manner befitting its systemic importance.